Table of Contents

How to Add Cash to Cash App Card?

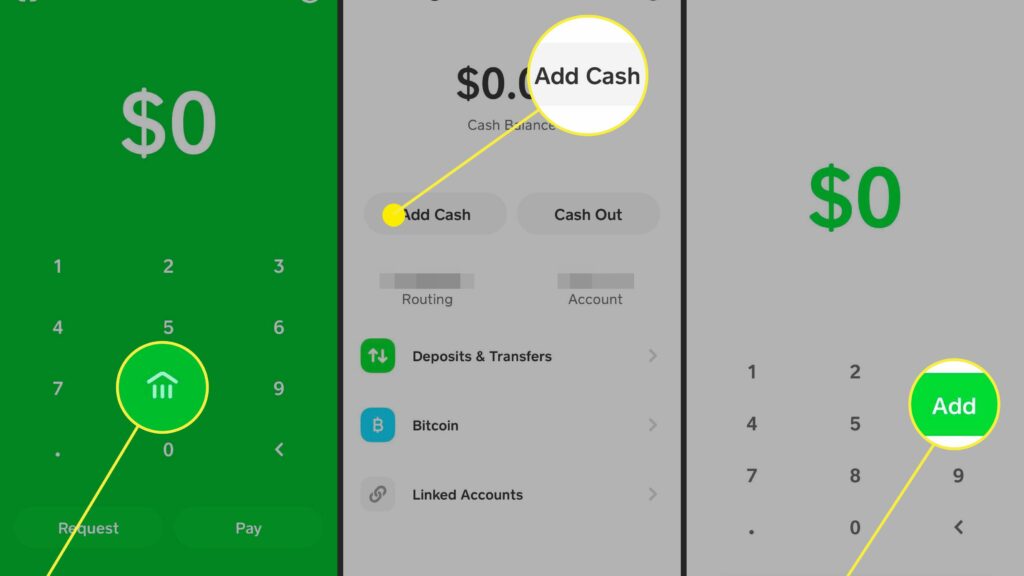

Adding Cash to your Cash App Card is as simple as connecting a bank account.

- To do this, simply open the Cash App and choose “Connect a bank account”.

- Next, you’ll be asked to confirm your login.

- Once you’ve done so, the Cash App will automatically transfer funds to your Cash App card.

Fees associated with adding cash to a Cash App card:

When adding cash to a Cash App card, it is important to know the fees. For transactions under $100, there are no fees. However, you may need to pay a fee if you want to use Lightning speed to transfer money. Otherwise, you can avoid the fees by using standard speed.

Cash App offers a free standard deposit option, which takes anywhere from one to three business days. However, you must pay a fee if you want your money deposited immediately, which is about 0.5%. There is also a 3% fee associated with credit card transactions, although you can avoid this fee by using another method, such as a bank wire.

ATM fees are another issue to consider when adding cash to a Cash card. Cash App reimburses ATM fees up to $7 per withdrawal, but this doesn’t cover fees for using other ATM machines. This option also requires that you deposit at least $300 per month.

Requirements:

- Before you can add Cash to your App Card, you must first link your bank account.

- Once linked, you can transfer money back and forth with ease.

- You will need to provide your bank account and routing number. You can only link one bank account at a time.

- Once the Cash App is connected to your bank account, you can load it with cash at participating retailers. The reloading process may take about 10 minutes.

- To add money, you will need to provide your account number and routing number.

- You can also transfer money from your debit card if you don’t have a bank account. This is a much faster process.

- If you don’t have a debit card, you can also load App with cash using participating Walgreens and Dollar General stores.

If you’ve already linked a bank account, you can deposit money to your Cash App at participating stores. In addition to using a debit card or credit card, you can also deposit money to Cash App via bank transfer. After you’ve done so, you can use your App card to buy goods. You can also use your App card to make online purchases.

Fees:

If you’re having trouble paying the fees on your App Card transactions, you should know your rights. While you can try to get your fees waived on your own, this can be a time-consuming process. In order to save yourself some time and effort, you can also use a service that specializes in fee appeals. DoNotPay is a service that will provide you with the best argument for your case and submit your fee waiver request directly to the merchant.

The fees associated with Cash App’s business version are less about the unique features of Cash App, and more about staying in compliance with their terms of service. For example, once the business version of Cash App is released to the public, it will have to report all commercial transactions to the Internal Revenue Service (IRS). Additionally, businesses are required to send a weekly limit of $7,500 and $17,500 each month.

To make deposits or withdrawals, you can link your Cash App account with your bank account. You must wait for one to three business days to process your transaction. You should also expect to pay a fee if you request an instant deposit.

Methods of adding cash to a Cash App card:

There are several different methods for adding cash to your cash App card. One of them is to use a bank account you’ve linked to Cash App. Another is to use a mobile check deposit. You can also get money from others to use as an App card.

You can also add money to Cash App using your debit or credit card. The process is fast and secure. To load your account, you need to know your bank account number and routing number. The process usually takes about 10 minutes. Then, you can use your debit card or bank account to transfer money to your App.

Conclusion:

Once you have enough money on your App card, you can make purchases and withdraw money from ATMs. However, you should note that you may have to pay fees when using an ATM. However, the cashback you receive will cover the cost. It is best to check the terms and conditions for fees before you make your first withdrawal.