Table of Contents

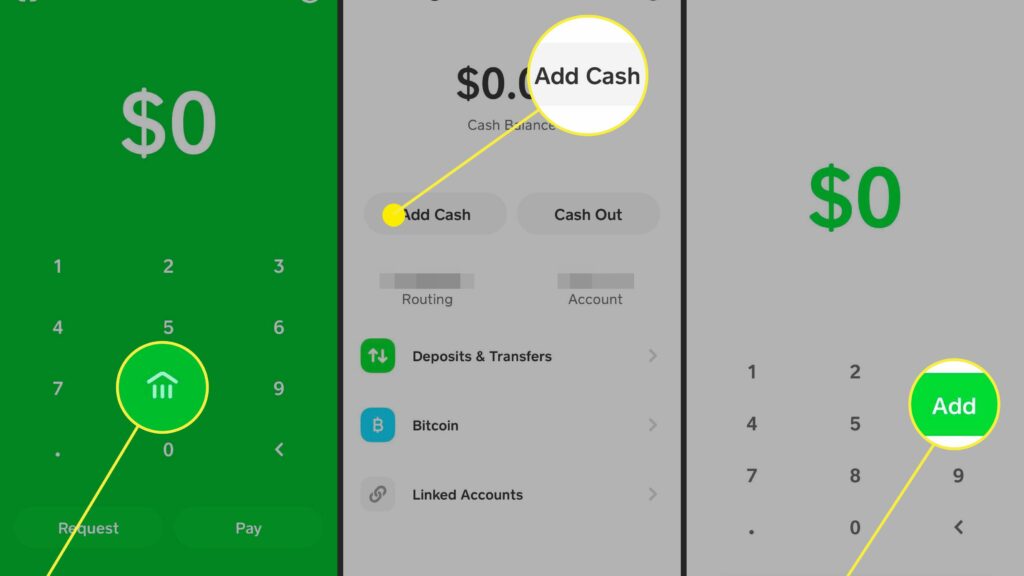

How to Check Your Cash App Card Balance?

If you’re considering using Cash App to make online payments, you may be wondering how to check the balance on your Cash App card. This P2P payment platform is a debit card that’s linked to your bank account, but it’s not FDIC-insured. Luckily, you can check the balance at any time online.

Cash App is a P2P payment platform:

The Cash App is a P2P payment platform that makes it easy to transfer funds from one person to another. With this app, you can send money to anyone by simply displaying a QR code. The money is then transferred from your Cash App balance to the recipient’s account or linked payment method. The app has some security features that can help you prevent fraud, but you should use caution to avoid scammers.

- Before you start using Cash App, you should first link your bank account.

- You can also link debit cards to the app later.

- When you connect your bank account to Cash App, you will be asked to create a $Cashtag, which is a unique username that you use to transfer money to other people.

- You can use your cash card to send money to others, but you must pay a fee of 3% for this service.

It is a Debit Card:

The Cash App card is a customizable black color debit card tied to a user’s Cash App balance. The card works anywhere Visa is accepted. Using Cash App is similar to using a traditional debit card, but there are differences.

- First, Cash App acts like a savings account. If you make a deposit, the bank sends a routing number to your Cash App account. This card can be used to make purchases online or at local stores. It can also be added to a digital wallet.

- The Cash App is a popular payment and wallet app with over 30 million monthly active users. It allows users to send and receive money from vendors and friends. In addition to this, the app now has a physical debit card for users. This card works at any participating retailer and can withdraw funds at ATMs throughout the US. Cash App users can apply for a Cash Card using the Cash App.

It is linked to a bank account:

With Cash App, you can store money on the card and transfer it to your bank account if you are linked to it. When you make a withdrawal, you will pay a small fee of about 25 cents. Within one to three days, the money will appear in your bank account.

You can call the Cash App customer care number to check your account balance. However, the phone number is often busy, and you will be directed to the chat option. There are also fake Cash Support phone numbers.

It is not FDIC-insured:

You may be wondering if your Cash App Card Balance is FDIC-insured. While it’s true that the FDIC insures bank deposits, the insurance only covers individual transactions. Moreover, the cash in your Cash App Card is not earning interest. If you want to protect your funds, consider opening regular savings or checking account with a bank.

You can check whether your Cash App Card Balance is FDIC-insured by reviewing the statement. While Cash App offers virtual currency services, you should understand that virtual currencies can fluctuate in value quickly and may result in substantial losses.

Thus, you should carefully consider whether or not you should keep your money in virtual currencies if you are under financial constraints. In addition, you should keep in mind that Block does not control the addresses of external virtual currencies.

It has customer support:

If you have questions about your Cash App Card Balance, you may want to contact customer support. In addition to being able to check your balance, you can also cancel your Cash App account and remove your card if you lose it. To cancel your account, you can follow the steps outlined below.

If you are unsure of your balance, you can contact Cash App customer support by phone. The phone number is often busy or directs you to the chat feature. In some cases, these customer support lines are fake, so be aware of these.