Table of Contents

Can You Add a Credit Card to Cash App?

If you want to use Cash App to make money transfers and receive cash, you may have a question: Can you add a credit card? While it is possible to add your credit card to Cash App, you will still have to pay a fee when making a transaction. So, the first thing you should do is add a debit card first.

Cash App is a peer-to-peer financial app:

Cash App is an app that allows you to send and receive money between people using their mobile phones. Once you’ve sent or received money, the app notifies the person you’re paying. The app also allows you to deposit money directly into their bank account or linked debit card. It’s free to download the app and use.

Cash App is one of the most popular peer-to-peer financial apps. The service was launched in 2013 and is owned by Block, Inc., a company that previously sold point-of-sale hardware and software to small businesses. It offers many features, including purchasing bitcoin, transferring stocks and ETFs, and even a debit card. Users can spend the funds they receive through Cash App and even get a cash boost when they spend it.

It allows you to link a credit card:

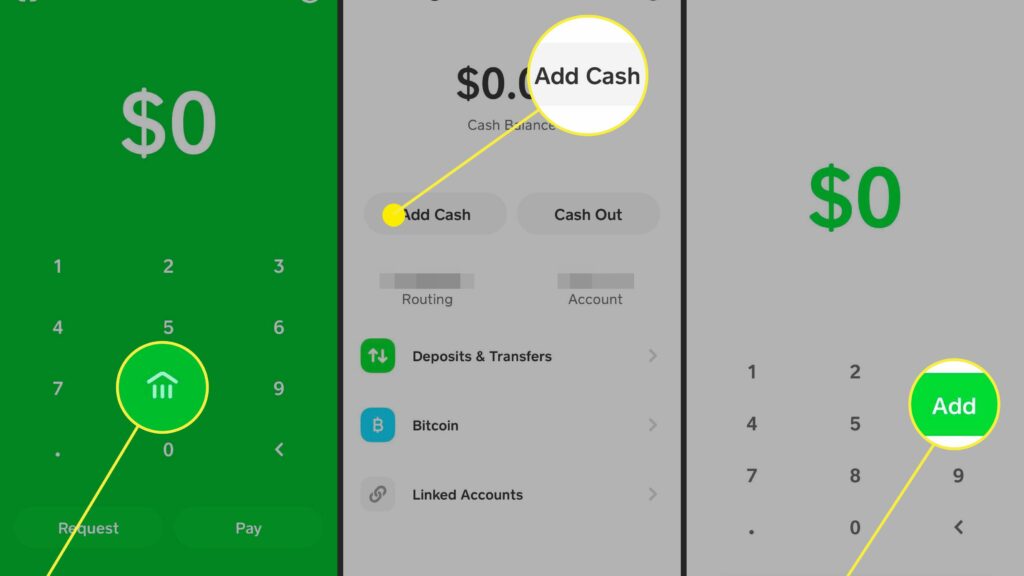

Cash App allows you to link a credit or debit card with the app, allowing you to make transfers between cards. This is great for people who use debit cards as payment options. To add a debit card, open the Cash App and tap the Account icon. From there, select Linked Banks. Enter the details of the debit card and you’re ready to go.

The Cash App works with major credit and debit cards, including MasterCard and Visa. Simply enter the amount you want to transfer and choose a recipient. You can use the app to withdraw or send money to friends and family.

It charges a transaction fee:

Cash App charges a transaction fee when you use your credit or debit card to pay for transactions, which is typically around 1.5 percent of the total amount you deposit. You can send and receive up to $250 within seven days and up to $1,000 within 30 days. You can increase your limits after confirming your identity. To do so, you’ll need to input your full name, birthday, and last four digits of your social security number.

While Cash App is convenient for sending and receiving money, it’s important to note that it’s not a bank. If you’d like to add a credit card, you can do so in the Linked Banks area. You can then input the credit card number and send money to the person you choose.

It does not currently support PayPal:

Cash App uses encrypted programming to protect all transactions and personal information. In addition, the app offers a secure login, so that you can protect your login details. You can also contact the customer service team if you have any questions. Despite the secure system, there are some security risks associated with Cash App. For example, if you are not using your app regularly, your balance may freeze.

Cash App supports most major credit cards and prepaid cards. However, it does not currently support PayPal or business debit cards. It also does not support ATM cards or Paypal.

It is not FDIC-insured:

Despite its name, Cash App cannot accept credit cards that are not insured by the Federal Deposit Insurance Corporation (FDIC). This is a drawback, but it is worth noting that Cash App is a bank-chartered financial institution and does not charge a fee to accept credit cards. Bank accounts are FDIC-insured, which ensures your funds will be safe in case of bank failure.

The Cash App service offers direct deposits and withdrawals and allows users to receive funds up to two days earlier than they would with a traditional bank. Users can also use their balance to pay bills. Because Cash App is not a bank, the company is not FDIC-insured, but its banking partners are.