Table of Contents

How Do You Put Money on a Cash App Card?

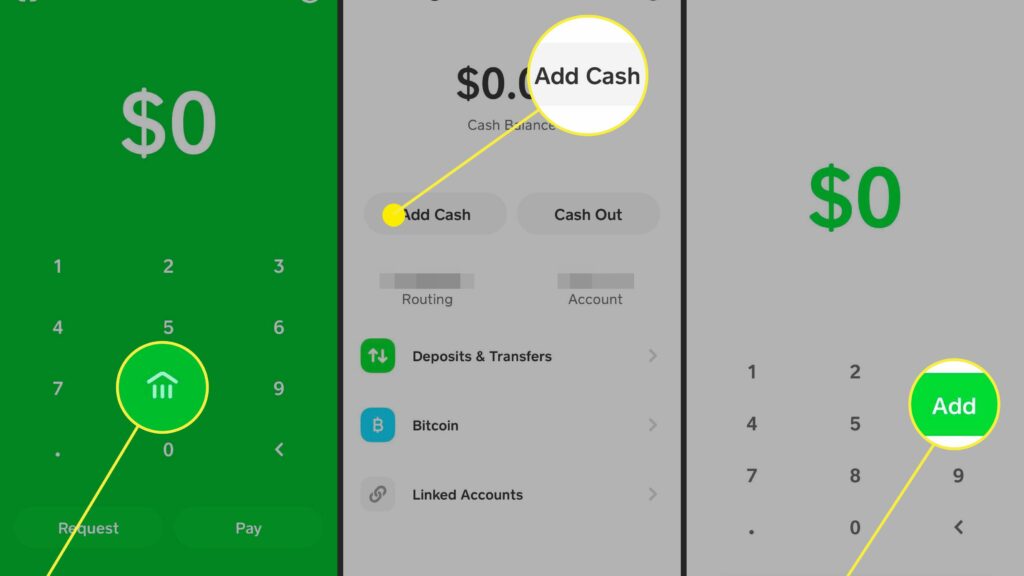

You can load Cash App with paper money at participating retail locations. You can find a location near you, and get directions using the app. Once you arrive, show the cashier your phone and explain that you want to load money onto your Cash App. The cashier will then give you instructions to follow.

How long do you put money on a Cash App card?

Whenever you make a purchase, you can choose to pay with the money on your Cash App card. You can put money directly onto your card’s balance by entering your account or routing number. This allows you to receive deposits up to two days earlier than you’d receive them from most banks. In addition, you can pay your bills using your balance on the app. However, you should be aware that Cash App is a financial services platform, not a bank. As such, they provide banking services through a network of bank partners.

The maximum amount you can deposit on your Cash App card is $500. You can also deposit paper money up to five dollars. There are also monthly rolling limits, which means you can only deposit a maximum of $4,000 in a month. However, you can increase your limit by proving your identity. To do this, you will need to enter your name, birthday, and last four digits of your Social Security number.

Which credit cards work with Cash App?

If you’re interested in using Cash App to make purchases, you should know which credit cards are compatible with it. You can use Visa, MasterCard, American Express, and Discover to fund your purchases with Cash App. After selecting your funding source, you simply enter the amount you wish to transfer and choose a recipient. Then you can send the money to your chosen recipient.

Cash App does accept credit cards, but you’ll have to pay 3% for each transaction. You’ll also need a debit card to make payments through Cash App. The fees vary depending on which credit cards you use. You can find out more information about Cash App fees by visiting its website.

The app does not accept all types of credit cards, including gift cards. But it does work with most major prepaid cards. It does not accept government-enabled prepaid cards, ATM cards, business credit cards, or PayPal cards. However, you can use prepaid gift cards, such as PayPal and Venmo, to send money to Cash App users. These cards also have a 3% transaction fee, so they’re not a great option for sending money.

Fees associated with instant transfers:

While Cash App makes sending and receiving money and transferring funds to a bank account quick and easy, certain transactions can incur a fee. To avoid these fees, consider sending money through a standard speed transfer or using a debit card. To learn more about fees associated with instant transfers, read the Cash App FAQ.

For most transactions, a cash transfer is free. However, if you’re making a larger transfer, you’ll need to pay a fee. The fees are typically between 0.25 to 1.75% of the total amount. The minimum fee is $0.25, while the maximum fee is $25. You can also find out if you’re incurring any fees prior to making a transaction, and how much you’ll be charged in the process.

When using the Cash App service, remember that your cash account balance isn’t insured by the FDIC, so if you lose your device, your money is not insured. However, the service is convenient if you need to send a small amount of money quickly and easily. You can also use the balance of your cash app card to pay bills and invest.

Where to find participating retailers:

If you’re planning on using your Cash App card at a participating store, you can easily find a list of participating locations on the app. You can also find a map that shows participating locations nearby. Once you have found a participating store, you can load the funds by showing the cashier your Cash App card and giving the cashier the phone number that’s associated with your Cash App account. You can complete this transaction easily and quickly, and it won’t take much time at all.

The Cash App card is a convenient and simple financial tool that you can use at thousands of retail locations. It can be used for in-store and online purchases, as well as to pay bills and send money to friends. It’s a great alternative to a traditional credit card and can help you rebuild your credit. You can reload the Cash App card at participating retailers including 711, Dollar General, Rite Aid, Target, and Walmart.

Cash App also allows you to withdraw funds, cash out, and make transfers to your debit card. Generally, standard deposits are free and take one to three business days, while instant deposits are available for a fee. The Cash Card comes with a physical or virtual Visa debit card and a number of cash boosts.