Table of Contents

How to Apply For a Cash App Card?

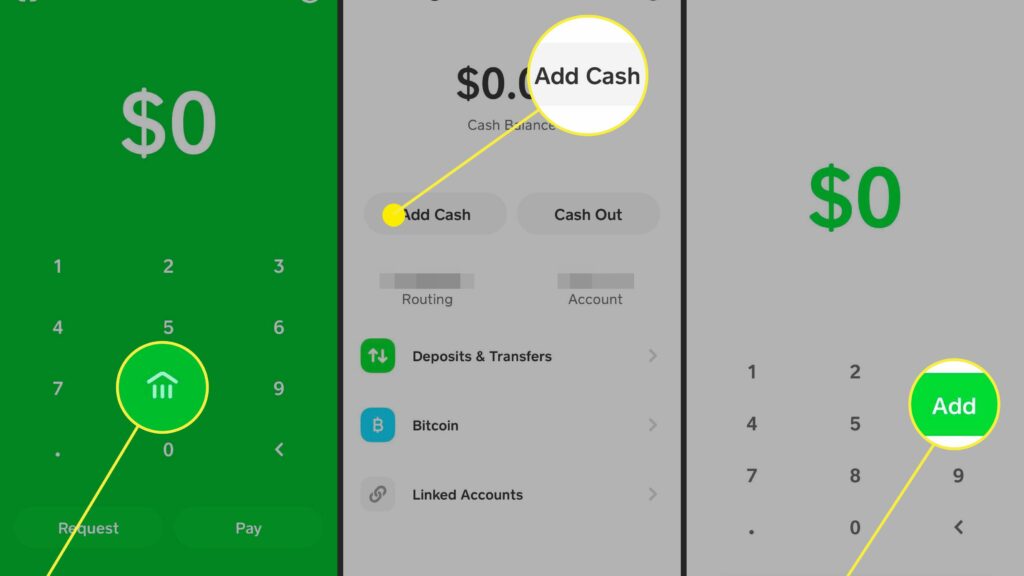

When applying for a Cash App Card, there are a few important details to keep in mind. First, you need to enter your first and last name, as well as your date of birth and Social Security number. After entering this information, click on the Next button, and then confirm your details. You’ll then be able to add cash to your Cash App account.

Fees:

Cash App has a debit and credit card similar to Venmo which has no annual fees or account maintenance fees. But you’ll still have to pay for some services like instant deposit and credit card payments. The service fee is 3% of the total amount. You can avoid this fee by avoiding instant deposits and transferring money from your available balance instead.

Cash App charges 3% of credit card transactions, which is common for businesses and payment apps. But you can avoid this fee by using your Cash App funds or linked bank account instead of a credit card. As with most credit cards, there are also limits on spending with Cash App. The maximum amount you can spend on a single transaction is $7,000, and there are also spending limits of $10,000 per week and $25,000 monthly.

Limits:

Cash App is a great app that allows you to make small payments on the go. While it is simple to install, there are some limits that you should be aware of. For instance, you cannot spend more than $7, 000 per day, or $15, 000 per month. You also should not use the Cash App to send money to strangers.

You may be required to pay ATM fees when using Cash App. It is also possible to incur additional fees if you buy or sell Bitcoin with the Cash App. These fees will be listed before the transaction. The funds on your Card are available to use immediately in most cases, but you may need to complete the transaction to make it available for use.

Limits on transfers:

When using a peer-to-peer transfer service like Cash App, it’s important to understand the limits on transfers. You should be aware of the limits on sending and receiving, as well as the limits on cash boosting and day trading. These limits may discourage heavy users from using the Cash App.

Limits on transfers with Cash App vary based on the card. Discover doesn’t classify Cash app transfers as cash advances, and other major card issuers may likewise have different rules. However, you should know that if you are a frequent user of the Cash App, you can raise your limit by proving your identity.

You can send and receive up to $250 within 7 days and $1,000 in 30 days, subject to verification. The verification process requires you to enter your full name, date of birth, and last four digits of your Social Security number.

Direct deposits:

If you’ve noticed that your cash App Card direct deposits have been delayed, there are a few things that you can check. First of all, make sure your Cash App is up to date and connected to a high-speed internet connection. Also, check the routing number of the sender to ensure that it’s correct. Once you’ve done that, you can contact the Cash App support team to resolve the issue.

The typical time frame for Cash App Card direct deposits is from one to five business days. However, the first deposit may take longer, depending on the employer. Fortunately, Cash App users can view their balances at any time via the app.

Limits on purchases:

Cash App has several features. One of these features is the ability to set spending limits. The default limit is $250 per transaction. You can increase this limit whenever you’d like, but it’s important to know what the limits are. You can increase these limits by verifying your identity using your full name, birth date, and the last four digits of your Social Security number.

Cash App has a number of limitations that may discourage heavy users. Some of these limits include transaction limits, ATM withdrawal limits, Cash Boost limits, and day trading limits. The transaction limit is one of the most important limits.