Table of Contents

How to Increase Your Cash App Sending Limit After Verification?

If you want to receive and send money with Cash App, you need to be aware of the limits that you have before you can send any money. Your limits will depend on your verification status. You should never try to send more money than you can handle without verification. It is therefore important that you follow the verification process step by step. So, read the article to get information on this Cash App Sending Limit After Verification.

Limits for sending and receiving money:

Limits on sending and receiving money from a business account can affect a business’s cash flow. Fortunately, there are ways to work around these limitations. One way is to verify your personal PayPal account before using it for business. Another way is to break up your transactions into batches. This is a simple solution that will help keep your workflow steady. Here’s how to do it: Go to the account’s settings page.

Fees for ATM withdrawals:

If you receive $300 or more in paychecks or unemployment insurance each month, you can get reimbursement for up to $7 of ATM fees each month. This reimbursement is offered for a period of 31 days. In this time frame, you can withdraw cash at any participating ATM, whether it’s a major chain or a local bank. Just submit a completed direct deposit form and the app will reimburse you the fee.

Before you can withdraw funds, you must first verify your account. This process takes a few minutes and requires a photo ID and a valid email address. Once your account is verified, you can enable blockchain transfers and withdraw Bitcoin using your Cash App. You can also sign in with a PayPal account. Verifying your account with Cash App takes just a few minutes. In case of any problems, you can look up common solutions to your problems on Cash App’s Help page.

Requirements to verify your identity:

Verifying your identity is a good idea, as it increases the security of your account and prevents fraud. To verify your identity, you will be asked for your Social Security number and date of birth, among other information. Once you’ve verified your identity, you can start sending and receiving money. You can also set up direct deposits, withdraw Bitcoins, and use Cash App for tax reporting.

You’ll need to fill out a few other forms to verify your identity on Cash App. Firstly, you must submit an email address. You’ll also need to provide information about your employment and income. Finally, you’ll need to take a picture of yourself. Ensure that the photo is in a well-lit area and shows your face clearly.

Increase your limit after account verification:

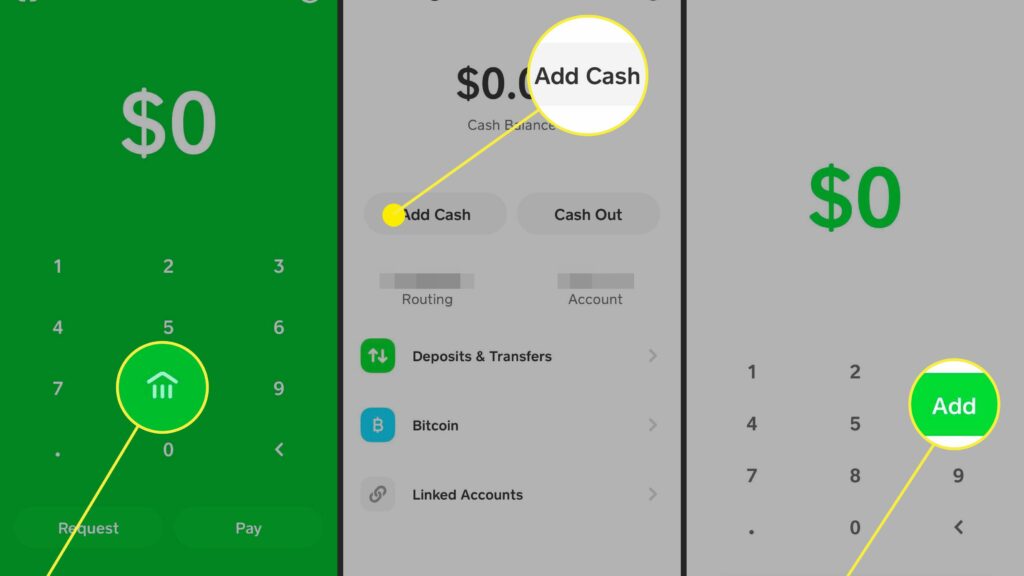

If you’re unsure how to increase your Cash App sending limit, there are some easy steps you can take to boost your limit. The first step is to verify your account with your bank. The verification process requires that you provide specific information about yourself. Once verified, your sending limit will be unlimited. For example, if you want to send $250 per week, you can send that amount. In 30 days, you can send $1000.

Once your account is verified, you can start sending and receiving money through Cash App. You must be sure to provide some personal information to verify your identity, including your date of birth and the last four digits of your Social Security number. Otherwise, your request will be declined. Once you verify your account, you can send and receive money from anywhere in the world, and you can even send money to multiple recipients.

Steps to add a bank account to Cash App:

Adding a bank account to your Cash App account will increase your sending and receiving limits. The initial limit for sending and receiving money on Cash App is $250, which is limited to your first seven days of using the app. But once you verify your account, you can send and receive up to seven thousand dollars per week and as much as $17,500 per month. You can increase these limits by verifying your account details, such as your full name, date of birth, and last four digits of your Social Security Number.

To verify your bank account, first, add it to the Cash App. You will need to provide the name and debit card number of the account that you want to link to the Cash App. If you don’t have a debit card, you can use your phone number or email address. To add the bank account, you’ll also need to choose a $Cashtag for your account, which should be at least one letter long and contain at least twenty characters. Once you’ve verified your account, you’ll be able to view your transaction history and make payments through Cash App.