Table of Contents

Cash App Sign-Up Card – What You Need to Know?

If you’re considering signing up for the Cash app, there are several factors that you should consider. These factors include fees, benefits, and security and verification. This article will provide you with important information. Ultimately, you’ll have a better understanding of which app is best for your needs. We’ll also look at some of the features that make these apps unique.

Fees:

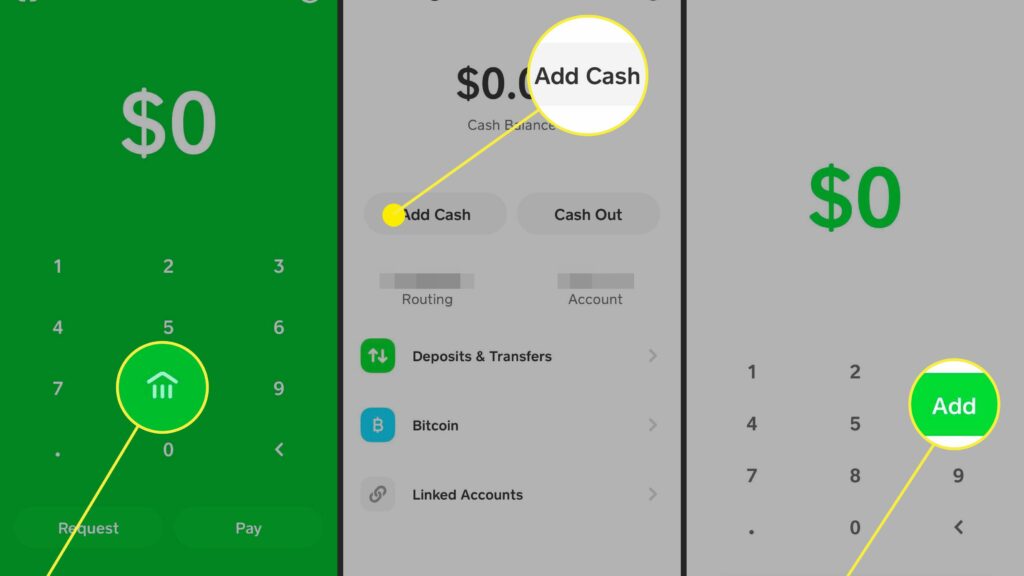

While Cash App doesn’t charge fees for signing up, it does add a fee when you use your card to transfer money. This fee is the same as other payment apps and businesses charge. If you want to avoid this fee, opt to make your transactions via a standard transfer, which takes about two days.

While Cash App does charge a $2 fee per ATM transaction, the company reimburses it if you deposit more than $300 into your account each month. You can also choose to receive your money via a direct deposit, which eliminates any fee associated with a cash withdrawal. Another perk of Cash App is that you can send money to anyone with just their name or their “Cashtag” if you prefer.

In addition to sending and receiving money, Cash App also lets you invest in Bitcoin and stocks. This app makes it easy to invest – you can set recurring buys and sells and monitor key metrics. Unlike other investing platforms, Cash App does not charge fees for signing up for an account or investing with the app. In addition, there are no fees to purchase Bitcoin or set up a direct deposit. However, there may be some fees associated with transferring and investing your money.

Benefits:

The Cash App is an online account that gives you access to your money, as well as many other benefits. You can use it as a debit card to pay bills and get cashback up to a certain limit. There are even special benefits for business users. Cash App is not a bank, but it works with a number of banks to provide banking services to its users.

The Cash App also allows you to receive and send money from your peers. It also offers an option to request a physical debit card that you can use to make real-world purchases. You’ll find that cash-back cards offer similar benefits, but cash-app users can receive even more.

The Cash App also allows you to invest in stocks. You can buy stocks for as little as $50. If you have a bank account, you can link it to Cash App and purchase stocks and ETFs. The Cash App also accepts Bitcoin. The app’s fees are two-fold: a service fee per transaction and an additional fee based on volatility.

Security:

There are several precautions that you need to take to ensure the security of your Cash app sign-up card. These precautions include creating a secure password and enabling two-factor authentication on your phone.

- You should also keep your email account protected and never give your login credentials out to anyone.

- Also, you should also be wary of scams that ask for your login information through unsolicited text messages. These scams are known as “smishing,” which is a form of social engineering. They send you phony texts claiming to be from Cash App.

Conclusion:

One of the best ways to ensure the security of your Cash App sign-up card is to change the password regularly. You should choose a unique passphrase and use it for each account. You should also use different passwords for different online accounts, and store them in a password manager.